The Integrated Reporting Framework Becomes Part of the IFRS Foundation

The IFRS Foundation recommends that companies apply the Integrated Reporting Framework

The IFRS Foundation has been responsible for the Integrated Reporting Framework since August 2022. The International Accounting Standards Board (IASB) and the International Sustainability Standards Board (ISSB) have announced that they will integrate the Integrated Reporting Framework into their standardization projects in the future. The IFRS Foundation and the Chairmen of the IASB and ISSB encourage companies to report in accordance with IFRS and make the Integrated Reporting Framework the basis of their corporate reporting.

The International Integrated Reporting Council (IIRC) is a global coalition of regulators, investors, companies, standard setters, the auditing industry, academia, and NGOs. It was founded on the shared conviction that coordinated communication on value creation within a group of companies must represent the next step in the development of corporate reporting.

The IIRC, therefore, developed the international <IR> Framework back in 2013 to meet this need and create a basis for the future of corporate communications. The currently valid version dates from January 2022.

What Are the Core Objectives of the <IR> Framework?

Integrated reporting is a holistic concept that combines traditional financial reporting with non-financial reporting elements such as the sustainability report, the risk management report, and corporate governance aspects. In other words:

- Companies should sustainably improve the quality of the information provided to their investors to enable a more efficient and productive allocation of capital.

- Promoting the coherence of corporate reporting based on different reporting strands can positively influence an organization's ability to create value for stakeholders.

- Corporate accountability and responsibility for all value-creating input factors (e.g., financial, process, intellectual, human, and social) should be promoted, and understanding of their interdependencies should be improved.

- Integrated thinking in entrepreneurial action concerning value creation should form the basis for decision-making at all levels.

Due to changing economic conditions and social values, ESG aspects - in parallel with the IIRC's convictions - are becoming of central importance for future viability and, thus, also for shareholder value.

With the entry into force of the CSRD coming into force in 2024, listed corporate groups will have to integrate reporting on sustainability targets, the role of the Management Board and Supervisory Board, the company's most significant adverse impacts, and intangible resources not yet recognized in the balance sheet into their reporting. As the directive will gradually extend the group of users to smaller companies in the coming years, auditing firms, for example, assume that around 15,000 companies in Germany alone will have to submit sustainability reports in the future.

With the IFRS SDS Standards S1 (General requirements for the disclosure of financial information on sustainability) and S2 (Climate-related disclosure), the ISSB has already published standards that bring the EU regulations to life and are intended to provide companies with application security. Integrated Reporting (IR) is intended to provide a comprehensive framework for this in the future, which takes into account a company's financial performance, sustainability, and other value-creating factors in a coherent manner. Many members of the financial community believe that ESG issues are relevant to the value of companies - and are, therefore, interdependent with IR. As a key player, the finance function should fundamentally incorporate this fundamental conviction into its remit and use "integrated thinking" to consider the financial and non-financial dimensions of the company's activities on an equal footing.

To integrate the reporting requirements of the <IR> Framework and SDS standards, the IFRS Foundation has provided users with a mapping. This table maps the key requirements of IFRS S1 and IFRS S2 to the content elements of the <IR> Framework and shows how disclosures in accordance with IFRS S1 and IFRS S2 can be included in an integrated report.

What Are the Challenges of Implementation?

When introducing an integrated reporting approach, corporate groups can face numerous challenges that can often only be overcome with external support, for example:

- Heterogeneous data situation: One of the biggest challenges is integrating financial and non-financial data is one of the biggest challenges. Data often comes from various sources, has different formats, or contains duplicates.

- Regulatory requirements: Inconsistent regulatory requirements (e.g., IFRS SDS vs. EFRAG ESRSs vs. GRI) increase complexity, making the implementation of IR more difficult.

- Costs and resources: The switch to IR can initially entail high costs and resources. This applies, in particular, to smaller companies that may not have the necessary means and capacities.

- Organizational change: The introduction of IR often requires a shift in corporate culture. Employees should understand why IR is important and how it contributes to value creation or funding (e.g., through the issue of green/social bonds). The initial impetus for change should come from the CFO. The accompanying governance should be at home in the finance department.

What Solutions Are Conceivable for the Technical Implementation of Integrated Reporting?

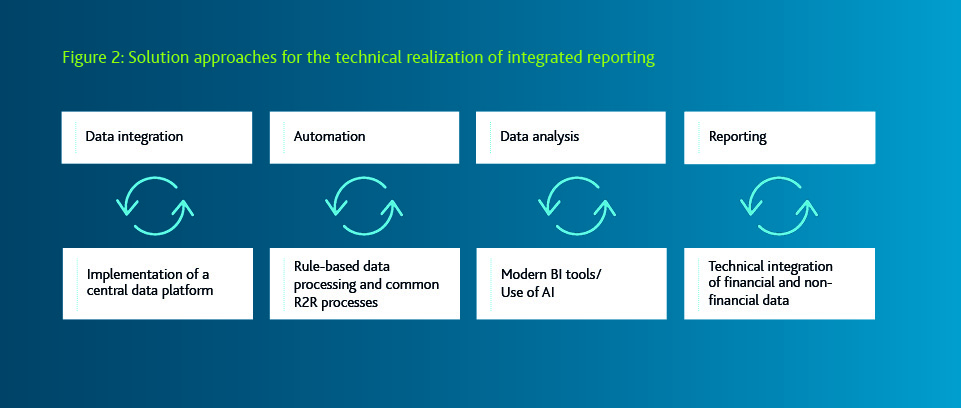

The technical implementation of an integrated approach to reporting can only work if controlling, accounting, and IT work together with a strong willingness to cooperate and maximum transformation speed. In practice, the following areas of work have proven to be essential in such a project setup:

- Data integration: The implementation of a central data platform that collects and integrates all relevant information. This can be achieved through the use of ERP systems, e.g., SAP Central Finance.

- Automation: A high degree of automation avoids manual intervention during data entry and provides scope for data interpretation.

- Data analytics: Advanced analytics tools help to identify trends and make informed decisions (e.g., by increasing cash flow forecasting accuracy for liquidity planning and risk management), further increasing the value of an integrated database.

- Reporting: User-friendly UX and standardized reporting formats that present both financial and non-financial information in a clear and understandable way make it easier for stakeholders to understand the company's performance and value creation.

In Germany in particular, the SAP is considered a role model in the consideration of the <IR> framework for corporate reporting. The company has introduced IR to provide stakeholders with a holistic view of its financial and non-financial performance. Key success factors were the creation of a central data integration platform, active stakeholder management and the use of modern tools such as SAP S/4HANA, SAP Group Reporting, and SAP Analytics Cloud.

The agenda of the 78th Business Economists' Day of the Schmalenbach Gesellschaft e.V., which recently took place as usual in Düsseldorf, shows just how topical the subject of "Integrated Reporting" is in the professional community. Many of the working group contributions, which combine academic research with the experience of business practitioners, were entitled "Connectivity in Financial Reporting".

Written by

Prof. Dr. Martin Wünsch is an expert in financial reporting and SAP S/4Hana Finance Consulting. He is familiar with this field from various perspectives, e.g., Big4-Audit, Corporate Functions, or Management Consulting. He holds a chair in Business Administration, in particular in Int, Accounting & Controlling, at the FOM University of Applied Sciences Düsseldorf and regularly publishes on current topics in financial reporting.